Maximize Your Insurance Coverage with SBI Simply Save Card Fees

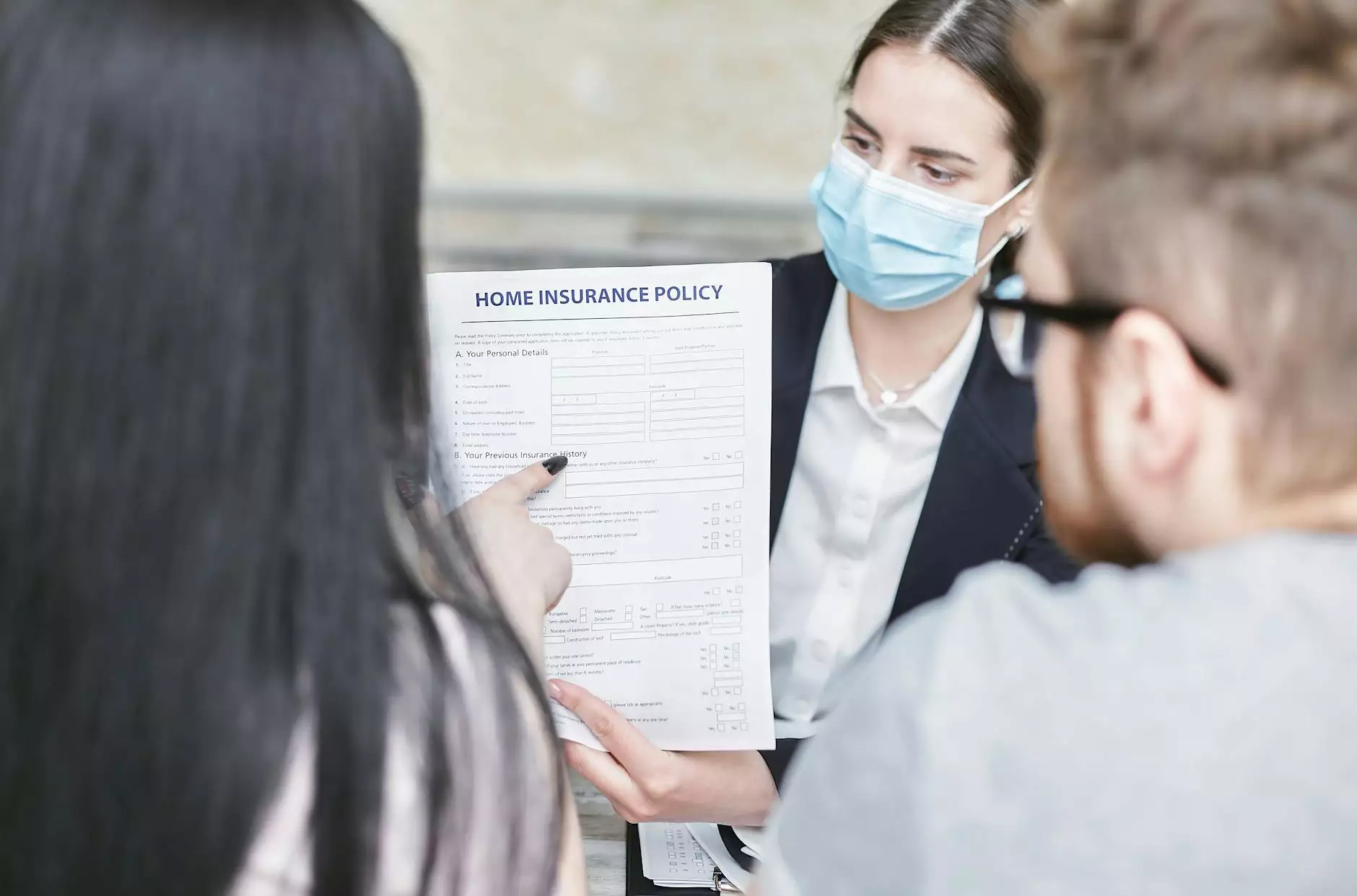

The Importance of Insurance in Today's World

Insurance plays a crucial role in safeguarding our financial security and protecting us from unexpected events. As responsible individuals, it is essential to have adequate insurance coverage to protect ourselves and our loved ones.

Introducing SBI Simply Save Card Fees

One insurance product that stands out in the market is the SBI Simply Save Card Fees. Designed to provide comprehensive protection, this card offers a wide range of benefits tailored to meet your specific needs. Whether you are looking for life insurance coverage, health insurance, or both, SBI Simply Save Card Fees has got you covered.

Benefits of SBI Simply Save Card Fees

- Flexible Coverage Options: With SBI Simply Save Card Fees, you have the flexibility to choose the coverage amount that suits your requirements. Whether you want a small policy to cover immediate needs or a larger one to secure your long-term financial future, this card offers ample options.

- Financial Security: By opting for SBI Simply Save Card Fees, you ensure that you and your loved ones are financially secure in times of unforeseen circumstances. In the event of a critical illness, disability, or unfortunate demise, the insurance coverage provided by SBI Simply Save Card Fees offers much-needed financial support.

- Tax Benefits: Investing in SBI Simply Save Card Fees not only provides financial protection but also comes with attractive tax benefits. You can avail deductions on the premium paid, helping you save on your tax liabilities. It's a win-win situation!

- Peace of Mind: Knowing that your insurance needs are taken care of with SBI Simply Save Card Fees brings peace of mind. You can focus on your daily life, career, and family without worrying about what the future may hold.

- Convenient and Hassle-Free Process: Applying for and managing your SBI Simply Save Card Fees is a breeze. The user-friendly online platform ensures a smooth experience, allowing you to easily access your policy details, make premium payments, and stay updated on any changes.

Choose Life Insurance with SBI Simply Save Card Fees

Life insurance coverage is an essential aspect of financial planning. SBI Simply Save Card Fees offers various plans to cater to different life stages, ensuring that you have the right coverage at every phase of your life.

Term Insurance:

Term insurance provides you with comprehensive coverage for a specific period, allowing you to secure your loved ones' financial future. With competitive premiums and flexible terms, SBI Simply Save Card Fees offers term insurance plans that suit diverse needs.

Whole Life Insurance:

If you are looking for lifelong coverage, SBI Simply Save Card Fees offers whole life insurance plans. These plans not only provide financial security during your lifetime but also build a corpus that can be utilized to meet your future financial goals.

Invest in Health Insurance with SBI Simply Save Card Fees

Your health is your most valuable asset. SBI Simply Save Card Fees understands this and offers comprehensive health insurance plans that cover medical expenses, ensuring you receive the best possible treatment without worrying about the financial burden.

Family Floater Health Insurance:

Protect your entire family with SBI Simply Save Card Fees' family floater health insurance plans. These plans provide coverage for your spouse, children, and parents, ensuring all their healthcare needs are taken care of.

Individual Health Insurance:

If you prefer individual coverage, SBI Simply Save Card Fees also offers individual health insurance plans. These plans allow you to tailor the coverage according to your specific requirements, ensuring personalized and comprehensive protection.

Conclusion

When it comes to insurance coverage, SBI Simply Save Card Fees is a reliable and comprehensive option that can suit diverse needs. With its flexible coverage options, financial security, tax benefits, and convenient application process, it provides the peace of mind you deserve. Whether you are planning for your family's future or safeguarding your health, SBI Simply Save Card Fees can help you maximize your insurance coverage and secure your financial future.

InvestmentCover.com is your go-to platform for more information and assistance regarding SBI Simply Save Card Fees and other insurance products. Our team of experts is here to guide you and help you make informed decisions. Don't wait any longer – take a step towards a more secure future with SBI Simply Save Card Fees today!